Are these consultants and agents actually telling the truth? How financially helpless are seniors who only have basic Medicare coverage and, exactly what amount of "additional" coverage do they truly require? Around three years back, Senior Healthcare Advisors composed this blog post contending that most seniors with Medicare didn't need a Supplemental plan. Since I created that blog I've gotten various inquiries from seniors requesting more insight about Supplemental Health Insurance. and what they should hope to pay for different medical treatments.

In this segment, I will focus on the info introduced in our blog. I will show here in more prominent detail precisely what Medicare covers, the out-of-pocket health costs of a senior with Medicare only, will probably pay and what, if any, advantages these additional policies provide.

Medicare Part A: How Much Will a Hospitalization Cost You?

Suppose you're hospitalized and you only have Medicare Part A. What amount do you owe the hospital? For example if your hospitalization lasts 60 days or less, the appropriate answer is $1,340; not much in this case. This is a very essential point: For any hospitalization lasting 60 days or less, you will just owe $1,340 regardless of whether your doctor's charges surpasses one million dollars! The specialists (or doctors) who see you in the hospital will charge you independently, yet those bills are always covered by your Part B benefits.

For instance, beneath you can see a duplicate of a bill that a patient of mine as of late gave me. This bill is for somebody who was hospitalized for around a month. As should be obvious, the aggregate sum charged was over $700 thousand ($711,695.69) and, yet, the patient still just needs to pay $1,260 which was the Medicare Part A deductible in 2015.

Would it be a good idea for you to hope to ever be hospitalized for over 60 days? No!

The normal length of a hospital stay in the US is 5-6 days and that number has been going down yearly over 10 years. Even individuals who require a real medical procedure like a liver transplant or open heart medical procedure are typically home in around 7 days. I can't state that 60-day hospitalizations never happen in the US, yet they're about as uncommon as jackpot lottery winners.

Likewise, let's say you have Medicare Part A, there's no restriction to the number of times you can be hospitalized for up to 60 days as long as you go home for two months after every hospitalization. Presently, the average senior can expect hospitalization around 4 times while on Medicare, and that is over a 20-30 year time-frame. Crunch the numbers. What amount of that will truly cost you when compared with the cost of your Medicare supplemental premiums?

How Much Will Nursing Home Care Cost You?

In case you're prepared to leave a hospital facility, however not yet well enough to go home, Medicare will enable you to invest some time and energy recouping in a nursing home, usually at no additional charge.

If there is a chance that your hospitalization keeps going at three days then Medicare will cover up to 20 days in a skilled nursing facility without charging you a penny more than what you now pay for your hospitalization. That implies that your $1,340 Part A deductible will cover up to 60 days in the doctor's facility or hospital and up to 20 days in a nursing home if you require it. In the event that you require more time to recuperate in a Nursing home, it will cost you $167.50 every day for the following 80 (days 21-100). From that point onward, Medicare won't cover you.

Here is an essential point that each senior needs to comprehend: If Medicare doesn't cover a service, by and large, a supplemental polcy won't cover that service either.

Give me a chance to make that much more clearer: Unless your supplemental policy particularly states something else, it won't cover nursing home care past 100 days or any nursing home care not secured by Medicare. Medicare arrangements just cover the $167.50 charge per day for a Medicare licensed nursing home inpatient stay enduring over 20 days but never over 100 days.

Most supplemental policies will not cover hospital days that go past Medicare's lifetime benefit advantage limit either (which is exceedingly uncommon at any rate).

Try not to let health insurance agents mislead you about that either. In the event that your policy doesn't particularly say a service is covered, it's not covered.

Medicare Part B: What Does It Cover And How Much Will You Really Owe?

Medicare Part B takes care of outpatient restorative expenses. This also incorporates specialist's visits, blood and urine tests, x-ray, CT checks, MRI's, emergency room visits and any physician who sees you in the hospital. It also covers IV medicines that are given at nursing homes or infusion centers (includes chemotherapy) and observation stays in medical facilities that aren't regular admissions.

What Amount Of It Will You Pay?

Most blood and diagnostic tests are free. So if your specialist arranges a blood test to check your cholesterol, thyroid, blood tally, and so forth… at regular intervals to monitor how your drugs are functioning, those tests will cost you nothing! Preventive screening tests like routine mammograms and colonoscopies are likewise free with Medicare.

For clinical services, after you pay a $183 yearly deductible you're in charge of 20% of Medicare's approved cost. Medicare's expenses is regularly confusing for a great many people since it's ordinarily just a little portion of the bill charged for medical services.

Medicare has a set rate of installment payments for every single clinic and hospital services that is the same for any given area regardless of what amount is charged for the service.

At the end of the day, Medicare protects all Medicare beneficiaries from over-charging by doctor's facilities, specialists or some other healthcare provider. The doctor or specialist can charge Medicare $300 for an office visit, the hospital facility can charge $4,000 for a CT scan in any case, if Medicare says that office visit is worth just $80 or the CT exam $300, that is all they get. In the event that you have Medicare, federal law keeps any healthcare provider who accepts Medicare from billing you for a penny more than the sum Medicare approves for any service.

What's the amount the chemotherapy will cost you? Similarly as with everything else in healthcare, the cost of chemotherapy differs significantly depending upon the treatment. The greater part of the chemotherapeutic medications have been around for decades, a considerable length of time so they aren't that costly.

Here’s a billing statement that shows Medicare’s approved fee for a basic chemotherapy infusion:

In the most extraordinary cases any disease treatment may cost you as much as the price of a used automobile in the event that you include the cost of radiation treatment and a few courses of chemotherapy with a biologic agent and surgery. In any case, when I say "used automobile" I mean the cost of a used Honda Civic or a Ford Taurus, not an extravagant vehicle. That is the most extreme cost you may perhaps be hit with in the event that you only have just Medicare Parts A and B.

What About Cancer & Chemotherapy? How Much Will That Cost You?

The cost of cancer chemotherapy is likely the most costly medical treatment a Medicare beneficiary could confront. This is because a medical oncologists are paid increasingly more if they give more costly chemotherapy treatments. Oncologists in the US get a normal 6% commission on the cost of any medications they administer in their office. This commission will make a situation for conflict, especially for these specialists and doctors that has increased cancer chemotherapy fees.

All things considered, Medicare Part B covers IV treatment, including chemotherapy, when applied either in a infusion center or a nursing home . In the event that you get chemotherapy while you are hospitalized, at that point the cost of your chemotherapy is covered by your Part A deductible.

Here’s a billing statement that shows Medicare’s approved fee for a basic chemotherapy infusion:

In the most extraordinary cases any disease treatment may cost you as much as the price of a used automobile in the event that you include the cost of radiation treatment and a few courses of chemotherapy with a biologic agent and surgery. In any case, when I say "used automobile" I mean the cost of a used Honda Civic or a Ford Taurus, not an extravagant vehicle. That is the most extreme cost you may perhaps be hit with in the event that you only have just Medicare Parts A and B.

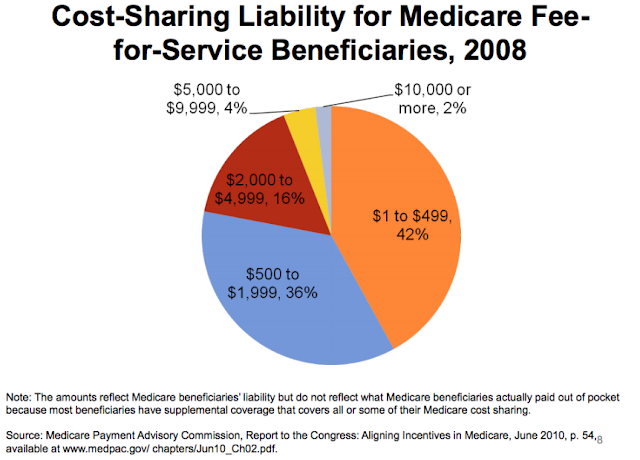

Here is a diagram which gives your approximate chances of spending in excess of a couple of thousand dollars in a year with Medicare:

Approximately eight out of ten Medicare beneficiaries wouldn't spend the cost of the their Supplemental premiums within a year and just around one out of fifty would spend more than $10,000. That implies that a normal Medicare beneficiary can hope to go around 50 years before being hit with doctor's expenses that surpass $10,000.

Would it be advisable for you to get a supplemental policy to take care of these potential expenses? That is your call clearly at the same time, now that you know your potential hazard, how about we discuss these approaches. In the first place, here is a link to get a free over the phone Medicare consultation with a Senior Healthcare Advisor. That should give you some thought of how great these policies truly are. What amount do they cost and what do they truly cover?

No comments:

Post a Comment